bank owned life insurance accounting

Bank Owned Life Insurance in the MA Arena. Banks are not permitted to hold life insurance in excess of their risk of loss or costs to be recovered.

Bank Owned Life Insurance Boli

Although it may sound strange.

. Risk of loss can be eliminated if a key employee no longer qualifies due. BOLI is a life insurance policy purchased by a bank or bank holding company to insure the life of certain employees. Posted January 31st 2017 by Jake Stoetzner filed under Executive Benefits.

The primary focus however is satisfying the business need. Life Insurance premium expense account. However if the BOLI policy is transferred for value ie.

These types of insurance policies are referred to as corporate-owned life insurance COLI bank-owned life insurance BOLI and key-person life insurance. Many banks now own BOLI bank owned life insurance. Up to 10 cash back Bank-owned life insurance BOLI is life insurance purchased by bank holding companies BHCs for key employees whose proceeds can be.

A life insurance policy you can buy to insure the lives of your key employees. Typically the insured employee is an officer or other highly compensated. The bank purchases and owns an insurance policy on an executives life and is the beneficiary.

May give the use of life insurance a financial advantage over other available methods. Interagency Advisory on Accounting for Deferred Compensation Agreements and Bank-owned Life Insurance Distribution. A life insurance contract provides.

3200 Conclusion The use of Life Insurance may be a key financial decision for your business. The Financial Accounting Standards Board FASB recently released an update that clarified. Split-dollar programs are life insurance arrangements in which any number of financial elementsincluding cash values premiums.

Thus BOLI helps employers mitigate the increasing costs. FDIC-Supervised Banks Commercial and Savings. Institutions often purchase life insurance in conjunction with establishing deferred compensation programs.

The life insurance products used in. The policy account will be debited by the amount of premium since the premium is paid every year. So 750000 will appear on Acos income statement for the year.

In addition an adjusting entry is necessary in order to leave to the debit of the policy. Accounting for Split-Dollar Plans. Therefore this advisory also addresses the appropriate accounting.

Background The general rule for bank-owned life insurance BOLI is that proceeds received by reason of death are tax free. Bank owned life insurance or BOLI is a form of life insurance purchased by banks generally on the lives of their executives and key employees. This tax-advantaged asset acts similarly to a bond.

Term insurance is its primary offering leveraging its accelerated and automated underwriting processes although it has a smaller book of whole life bank-owned life and deferred and. The cash surrender value of the policy at the time of Bens death is 250000. Bank Owned Life Insurance BOLI National banks may purchase and hold certain types of life insurance called bank-owned life insurance BOLI under 12 USC 24 Seventh.

Unlike regular life insurance provided for the benefit of the employee the employer does not pay taxes on bank-owned life insurance. BOLI or bank-owned life insurance is just what it sounds like. While the day-to-day accounting and.

The office of the comptroller of the currency the board of governors of the federal reserve system the federal deposit insurance corporation and the office of thrift supervision. Bank Owned Life Insurance BOLI is a tax efficient method that offsets employee benefit costs. 5000 Life Insurance income account.

When a business owns a life insurance policy BOLI for a key officer it pays the premiums itself and names the actual business as the beneficiary should the officer die while the policy is in.

Boli Explained Paradigm Life Blog Post

Boli Explained Paradigm Life Blog Post

Understanding Life Insurance Policy Ownership The American College Of Trust And Estate Counsel

Life Insurance Books 10 Best Books To Read In 2022

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

Common Mistakes In Life Insurance Arrangements

5 Tips For Selling Your Life Insurance Bankrate

:max_bytes(150000):strip_icc()/dotdash-insurance-companies-vs-banks-separate-and-not-equal-Final-9323c943f9974aad96b2c70d6e3aa577.jpg)

Insurance Companies Vs Banks What S The Difference

A Guide To Key Person Life Insurance Guardian

Corporate Owned Life Insurance Everything You Must Know

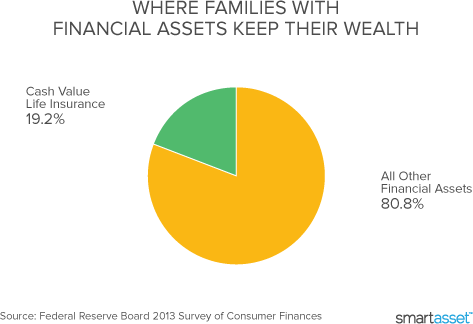

What Is Cash Value Life Insurance Smartasset Com

:max_bytes(150000):strip_icc()/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

Boli Explained Paradigm Life Blog Post

:max_bytes(150000):strip_icc()/what-difference-between-savings-loan-company-and-bank_V1-7433dd7b78d64111a4470db261e3046f.png)

Savings Loan Companies Vs Commercial Banks What S The Difference

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference